Itemized Bill Of Sale

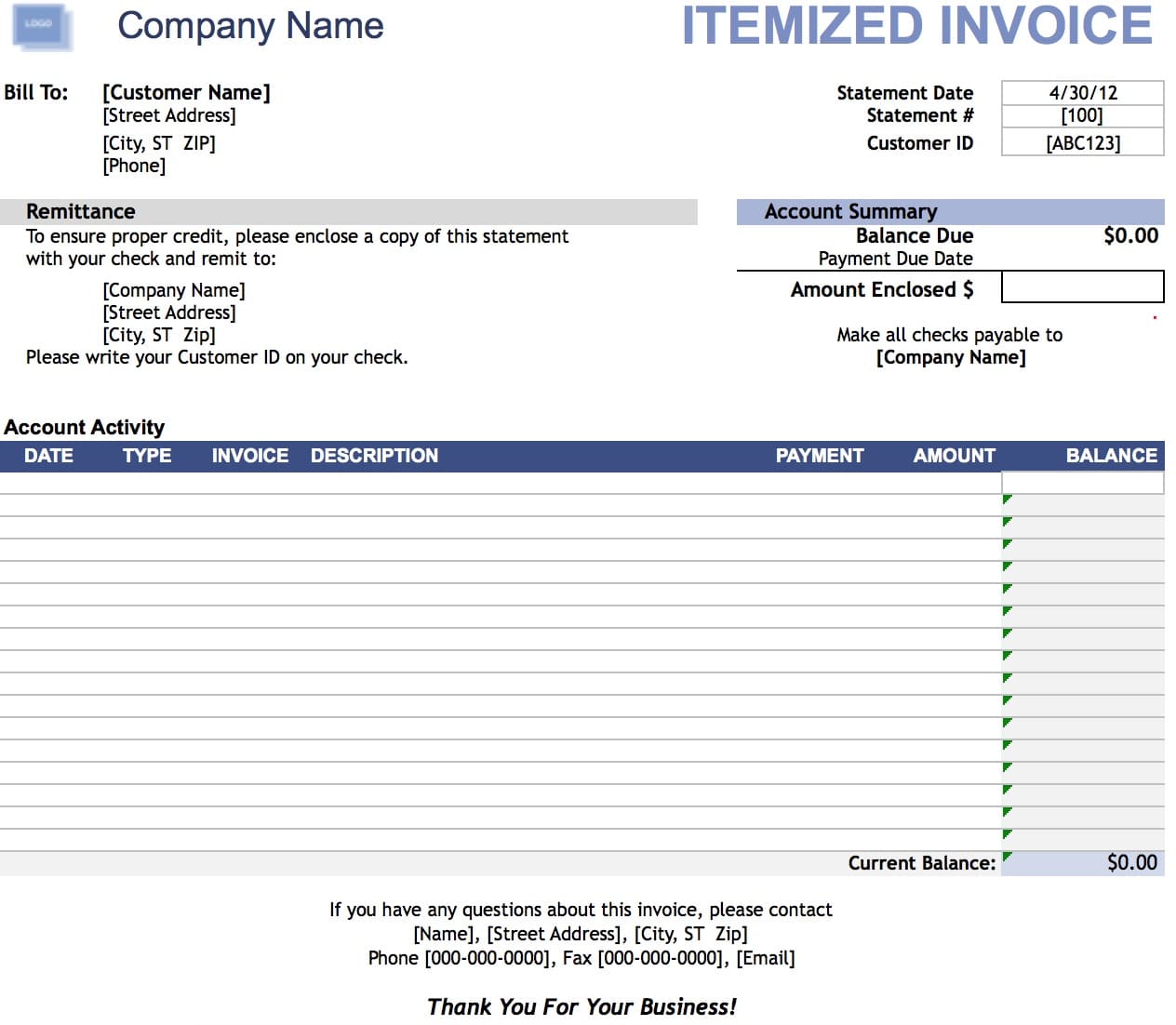

An itemized monthly charge for providing local broadcast stations. Itemized Invoice To be used prior to payment of a bill.

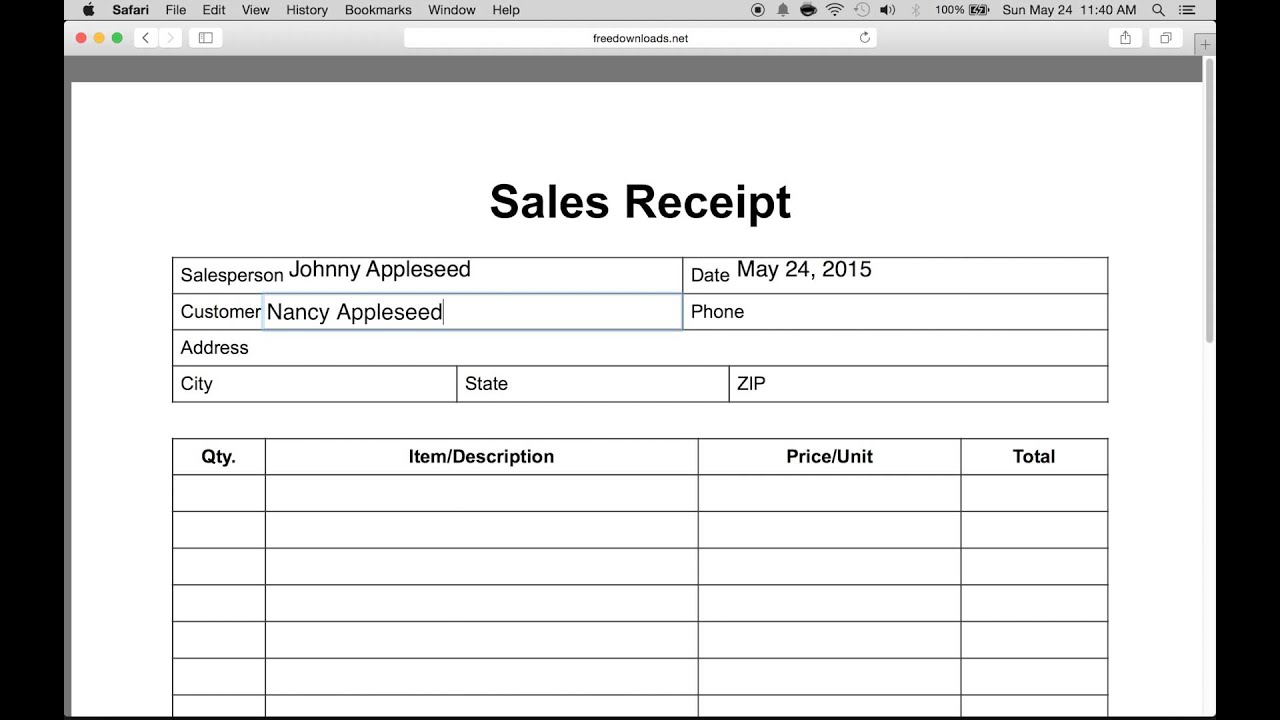

How To Write An Itemized Sales Receipt Form Youtube

Customers should receive advance notice before a price increase takes place.

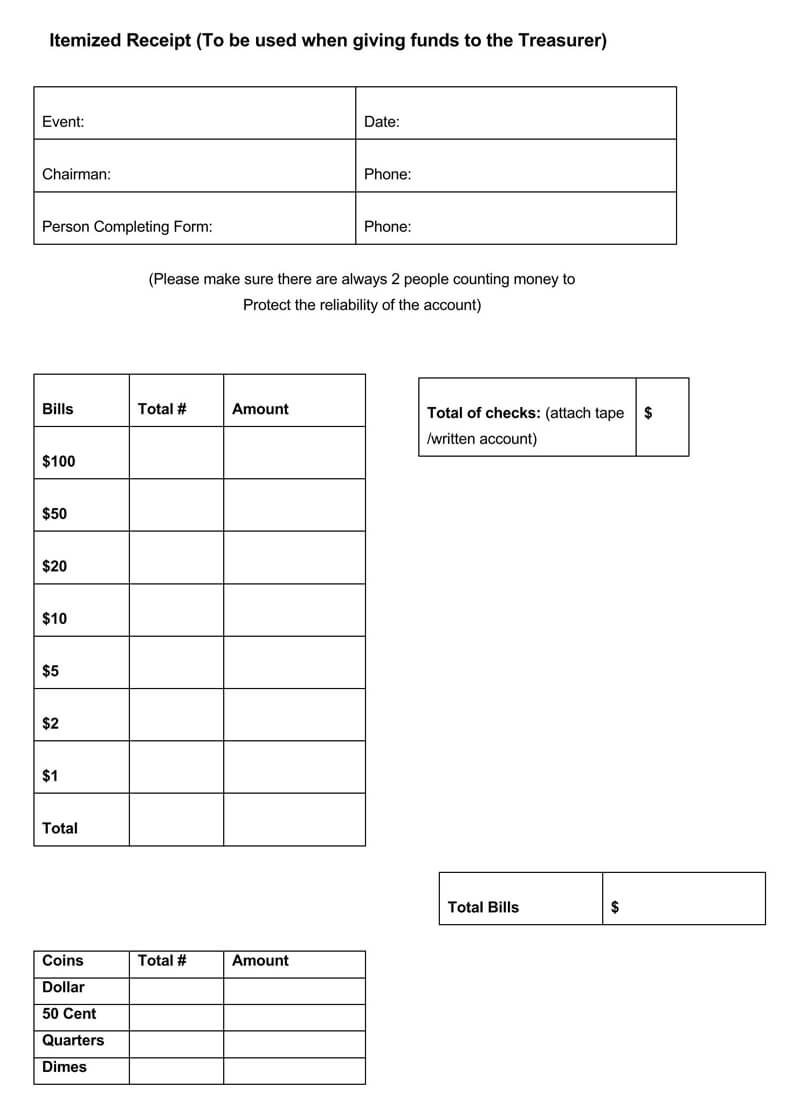

. Under the FDCPA if you send the bill collector a letter that disputes the debt andor requests verification of the debt within 30 days of receiving the initial written notice of the debt called a dunning letter then that bill collector must. The clients name and contact information. Each item or service would be listed per line.

Companies usually send out invoices to collect payment on products. An itemized deduction is basically a line-item receipt for expenses you paid during the tax year that qualify as legitimate deductions. What Are Allowable Schedule A Itemized Deductions.

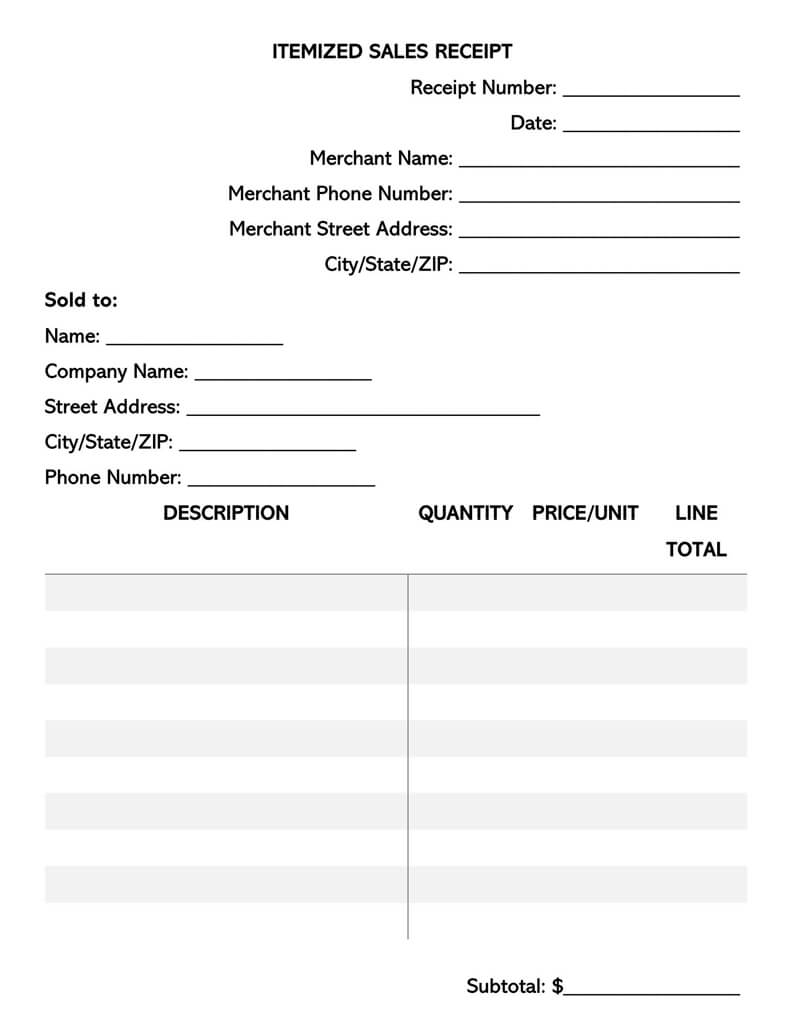

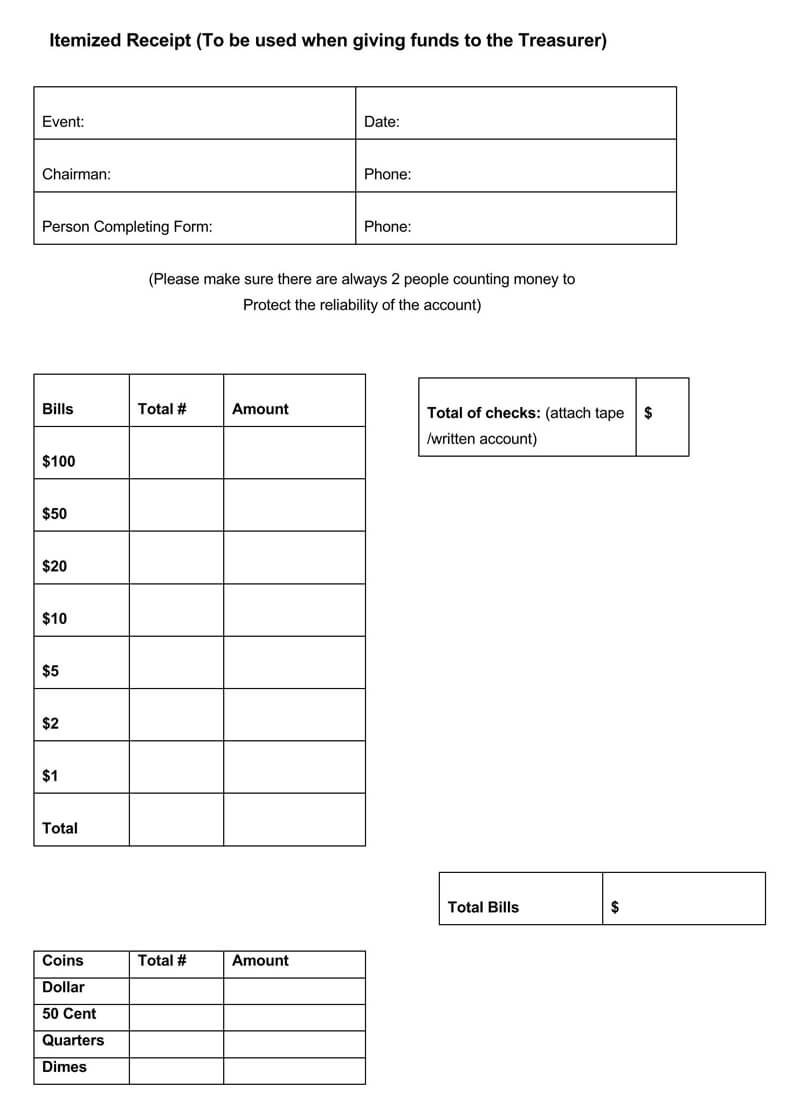

Acquire your receipt template from this page to dispense proof of payment for each item purchased by a Client. You can put these details at the bottom part of the bill such as the return policy customer guarantee and so on. Here is a list of allowable Schedule A itemized deductions.

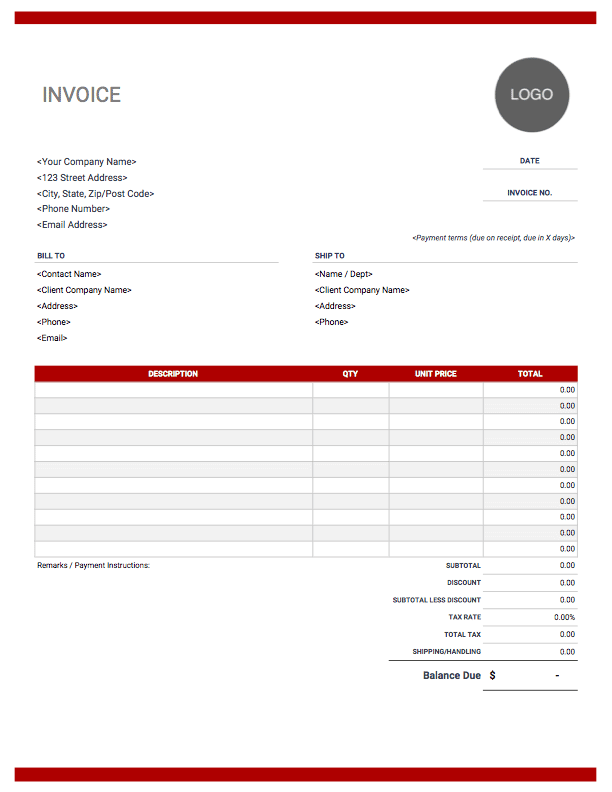

Please note starting in 2019 medical and dental expenses will be limited to amounts over 10 of AGI. Updated June 24 2022. The businesss name and contact information.

An invoice also includes the total amount owed due date and any additional payment terms such as the option to pay monthly versus a single payment. You can only deduct medical expenses in the year you paid them although payment can be made by cash check or credit card. California standard deduction rates are as the name implies a fixed sum however.

What is an Itemized Restaurant Receipt. The template of an original receipt contains essential information like the name of the company the purchased goods or services and the payment method used. Add additional necessary information.

Adobe PDF Microsoft Word docx or Open Document Text odt 1 Acquire Your Copy Of The Itemized Receipt. The debt collector cant. There was previously no limit.

All items would be calculated and the final amount with tax and any additional charges would be accurately displayed at the bottom of the form. An itemized monthly charge for. If the receipt is an itemized grocery pharmacy style receipt you will need to also enter each item.

State and Local Taxes. A statement of purchase is used chiefly when selling properties like cars aircraft motorcycles and other personal items like pets and furniture. Customize and download - no account needed.

The limit is also important to know because the 2021 standard deduction is 12550 for single filers and 12950 in 2022. An itemized invoice is a document that is used to provide an itemized statement for a client when goods andor services are purchased. A form of sales arrangement in which a seller of a good bills a customer for products but does not ship the product until a later date.

After offering their services they should issue receipts to the parents to confirm payment for the rendered services. If you offered more than one service make an itemized list. These are essential steps you need to follow for a concise and professional bill.

Immediately stop its collection activity and. It usually contains the date of purchase the amount paid description of the item sold and. The amount of money the client owes the business for its services.

2 Present The Merchant Information. A valid daycare receipt should include vital details such as the daycare name address date contacts information about the child receipt number name of the. Daycare centers take care of young children when their mothers are away mostly when busy working.

You would then claim the deduction on your 2022 tax. Medical and Dental Expenses. Enter the QTY Item Name and Price for each item you want to appear on the custom receipt.

Bill And Hold. A bill of sale is a legal document that records the transfer of a piece of asset or property from one party to another in exchange for money. It may come in the form of a point-of-sale an invoice or even an order confirmation.

Regional Sports Network fee. MakeReceipt will calculate the receipt Subtotal and Tax cost and then create a receipt grand Total. This fee includes charges from broadcast stations to carry their channels and may increase.

Send you information verifying the debt such as an account statement. Include details about the services rendered. Changes to this fee may also affect the TV channels you receive.

A credit invoice also called a credit memo is issued by a business that needs to provide a client with a. Standard invoices include the following details about the sale. The amount you can deduct for itemized deductions differs from person to person.

This will leave some high-income filers with a higher tax bill. In order for a transfer of ownership to occur. An invoice is a type of bill that includes an itemized list of those products or services that shows how much each item or service costs.

An itemized restaurant receipt is a receipt that contains five specific details. This is the case even if medical services were provided in a different year such as if you underwent treatment in December 2021 but you paid the bill in January 2022. This is very important especially when customers need to return an item to the manufacturer as they would have to present proof that.

So you need to have another 2550 of itemized deductions in 2021 and 2950 in 2022 beyond the SALT deduction in order to itemize. If you sell a customer a product or a service you need to give them an invoice bill by law if both you and the customer are registered for VAT a business to business transaction. You can easily add more items to the receipt by clicking Add another item link on.

The name of the paying customer the name of the restaurant the date the meal was purchased the items purchased and cost of each item and the total cost of the bill including the tax and tip amounts. The itemized deduction for all state and local taxes is 10000. Use this free receipt maker to quickly create receipts online with our professional receipt templates.

Free Itemized Receipt Template Word Pdf Eforms

20 Free Itemized Receipt Templates Word Excel Pdf

Free Itemized Receipt Template Word Pdf Eforms

Free 8 Itemized Receipt Templates In Excel Ms Word Number Pages

Free Itemized Receipt Templates Word Pdf Simple Formats

Free Itemized Receipt Templates Word Pdf Simple Formats

Itemized Bill Free Download From Invoice Simple